Traditional banks have long relied on call centers and manual processes, but fintech companies are taking a different approach. As the pressure to improve profit margins increases, automation has become a core part of delivering faster, more cost-effective support. This shift aligns with changing customer expectations—people want instant, hassle-free assistance, and many are willing to switch providers if they don’t get it.

With 82% of customers expecting immediate answers and nearly half willing to leave for better service, AI agents are becoming a practical solution. They help manage growing inquiry volumes, handle routine tasks, and keep things running smoothly, without stretching your team thin.

In this article, we’ll break down how AI agents support fintech operations, showcase real-world use cases, and walk through how to implement them.

Find out how AI agents help reshape customer support

How is AI used in fintech

Fintech companies use artificial intelligence to streamline support by automating tasks that go well beyond answering FAQs. These systems can process account-related questions, assist with transactions, and adjust to user behavior on the spot.

Fintech covers a wide range of services, including digital banks and wallets, payments, personal finance, investing, and lending. Across these areas, AI helps analyze large datasets and automate repetitive workflows.

Instead of sticking to scripted replies, AI in fintech helps with things like spotting suspicious activity or suggesting relevant financial products.

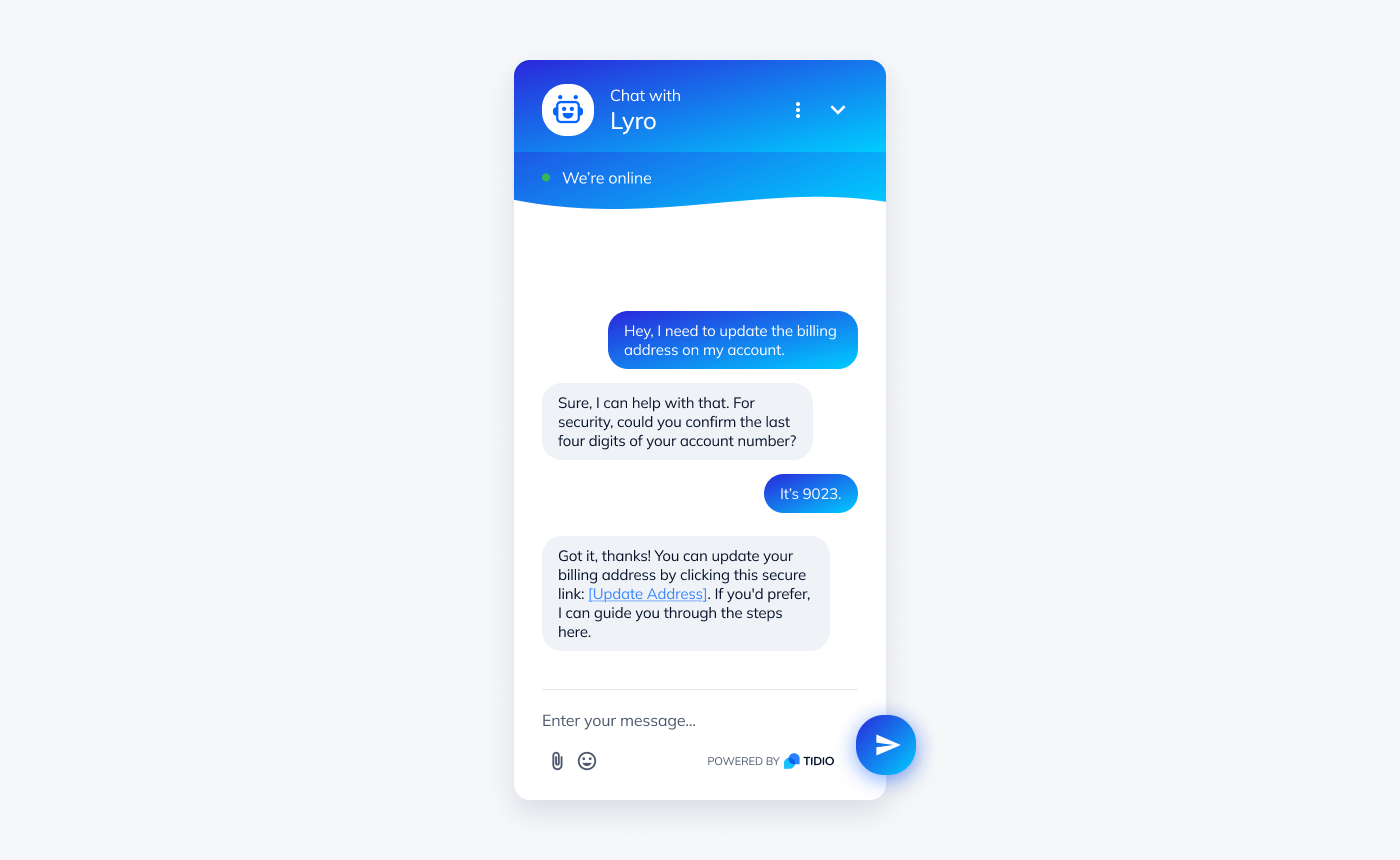

Let’s take Lyro AI Agent, for example. It connects with existing fintech workflows to speed up response times and reduce manual work. Lyro also handles ticketing automatically and routes conversations to the right team when a human needs to step in—all the while maintaining the business brand voice.

Read more: Find out all you need to know about Lyro—Tidio’s AI agent.

Use cases of AI in fintech

From handling routine inquiries to assisting with complex financial decisions, AI technologies help fintech companies provide reliable support without putting strain on human teams.

Here are key ways fintech businesses are putting AI to work.

Reducing costs

Customer support costs can add up quickly, especially as fintech companies grow. Hiring and training agents require significant investment, with the average agent salary reaching $70,000 per year. AI-powered agents offer a more cost-effective solution, handling routine inquiries and transactions for a fraction of the cost.

Unlike human teams that need to scale gradually, AI systems can instantly manage thousands of inquiries at once. This ensures customers get timely responses without increasing headcount. For fintech businesses, this means maintaining high-quality support without stretching budgets.

Shorter wait times also lead to better experiences, especially when customers need quick answers. With fewer delays, support becomes more responsive and less frustrating, which directly contributes to higher satisfaction scores.

AI agents can respond to thousands of messages without increasing costs, diminishing the need for additional human agents. In fact, fintech companies that implemented AI-driven automation have cut operational expenses by 13% and increased revenue by around 10%.

In fact, even the highest plans of Tidio are up to 80% more cost-efficient than hiring additional agents. Apart from cost savings, Lyro AI works alongside human teams, automating support requests and integrating with ticketing systems to reduce manual workload. This allows businesses to optimize resources while still providing responsive and efficient customer service.

Read more: Find out all you should know about chatbot automation.

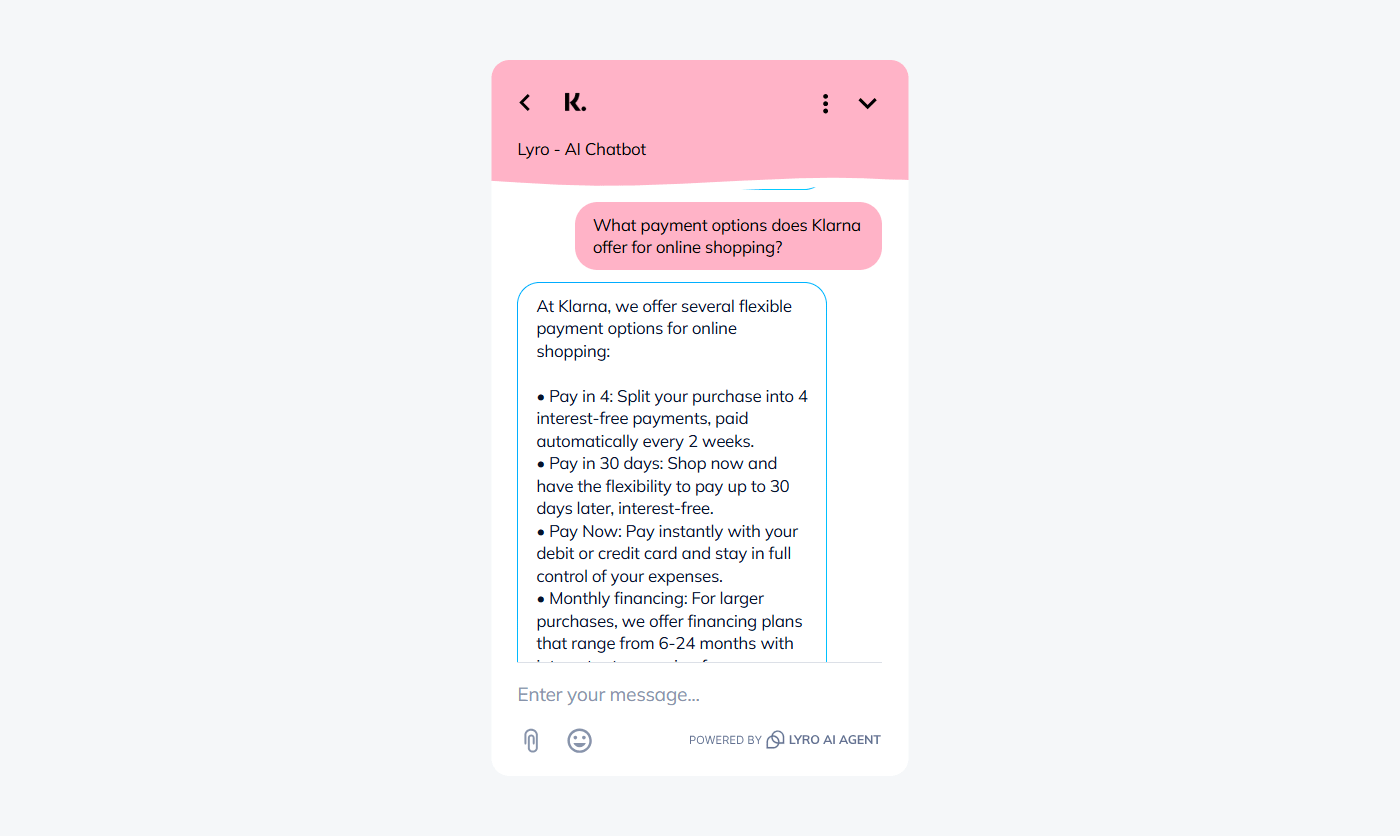

Offering support in multiple languages

As fintech companies expand into global markets, multilingual support becomes essential for serving diverse customer bases. Language shouldn’t be a barrier to good service, and AI agents are helping remove that obstacle.

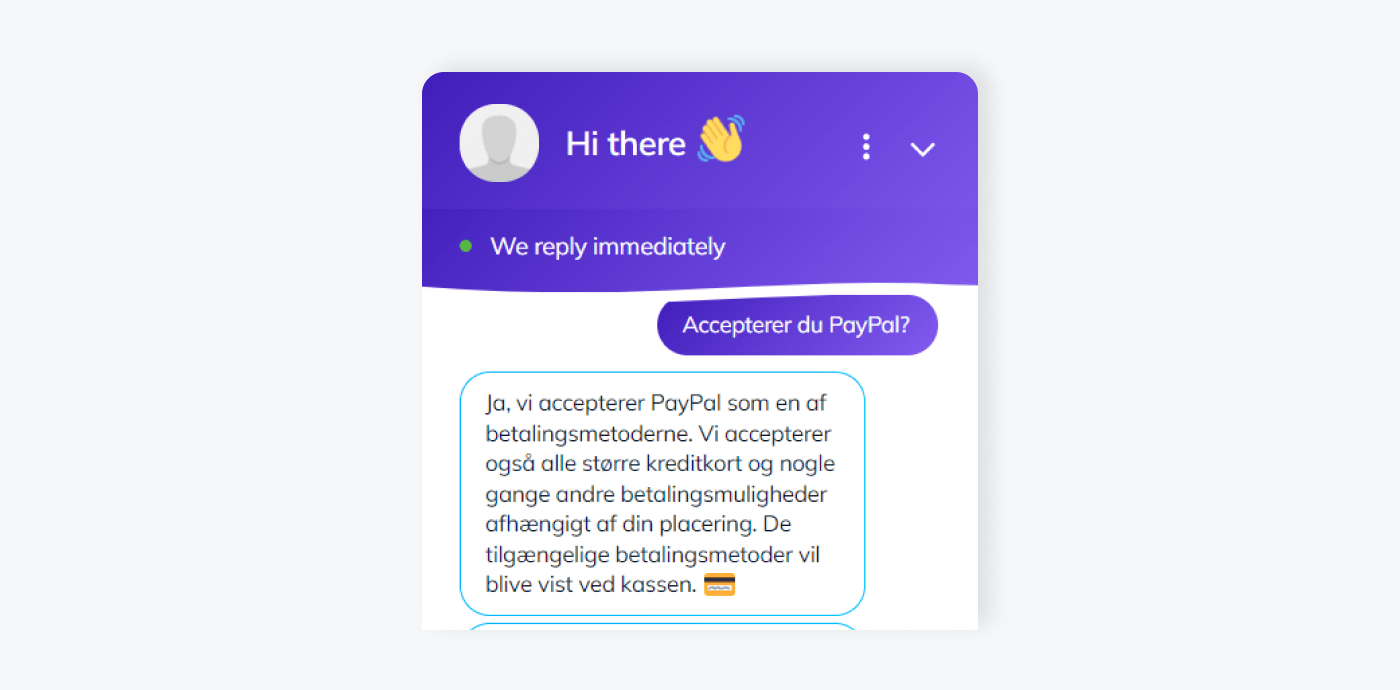

Tools like Lyro AI Agent come with built-in multilingual capabilities, making it possible to engage users in their preferred language without adding pressure on support teams. Lyro currently supports English and many other additional languages, including Spanish, Portuguese, French, Dutch, Italian, and German.

When paired with Tidio’s multilingual live chat widget, Lyro can automatically detect a customer’s language and respond accordingly, helping create smoother and more inclusive interactions.

This feature is especially valuable for fintech companies operating in multilingual regions or with international users. By offering localized support, businesses can improve customer satisfaction, expand their reach, and reduce friction during key moments, like onboarding, product selection, or account verification.

Multilingual AI also enables 24/7 coverage in multiple languages, making support more accessible across time zones. It’s a practical way to provide consistent, personalized service without needing a full team of agents for each market.

Read more: Learn everything you should know to build a multilingual chatbot.

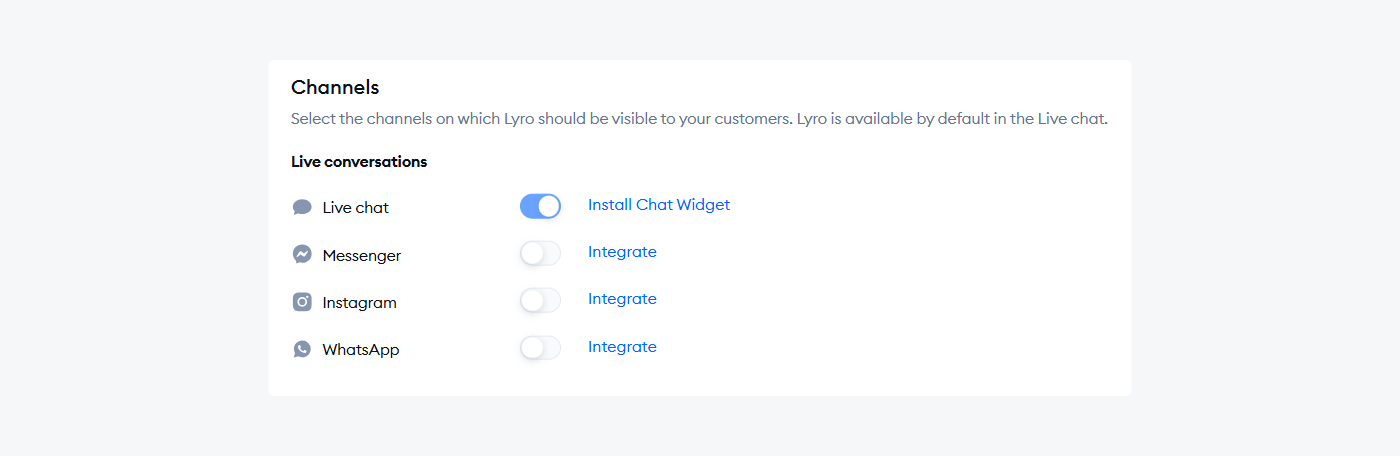

Supporting customers across multiple communication channels

Fintech users often switch between chat, email, and apps depending on what’s most convenient at the moment. And studies show that 50% of fintech users engage through three or more touchpoints. But when context is lost between the channels, customers end up repeating information, which slows things down and hurts the experience.

AI agents, like Lyro AI, help keep everything connected. A customer might start a chat on the website, and then follow up by email later. This software supports chat, web, and email channels, giving businesses a clear view of each interaction and helping customers pick up right where they left off.

Read more: Learn the benefits and best practices of multichannel customer service.

Meeting security and compliance requirements

Fintech companies handle large volumes of sensitive customer data, so meeting strict security and compliance standards is non-negotiable. Regulations such as GDPR, GLBA, and PCI-DSS require businesses to protect data privacy, prevent unauthorized access, and ensure that all processes are secure and accountable.

An effective AI solution must offer TLS encryption, secure data storage, two-factor authentication, and role-based access controls. These features help reduce risk while allowing companies to automate support tasks, without compromising user trust or falling short of regulatory expectations.

In addition to regulatory compliance, AI agents can assist with fraud prevention by detecting unusual behavior and flagging fraudulent activities in real time. By automating parts of the verification and data entry process, they not only help reduce human error but also strengthen security across the board. This level of oversight ensures that as your support scales, your customer protection does too.

Assisting in sales processes

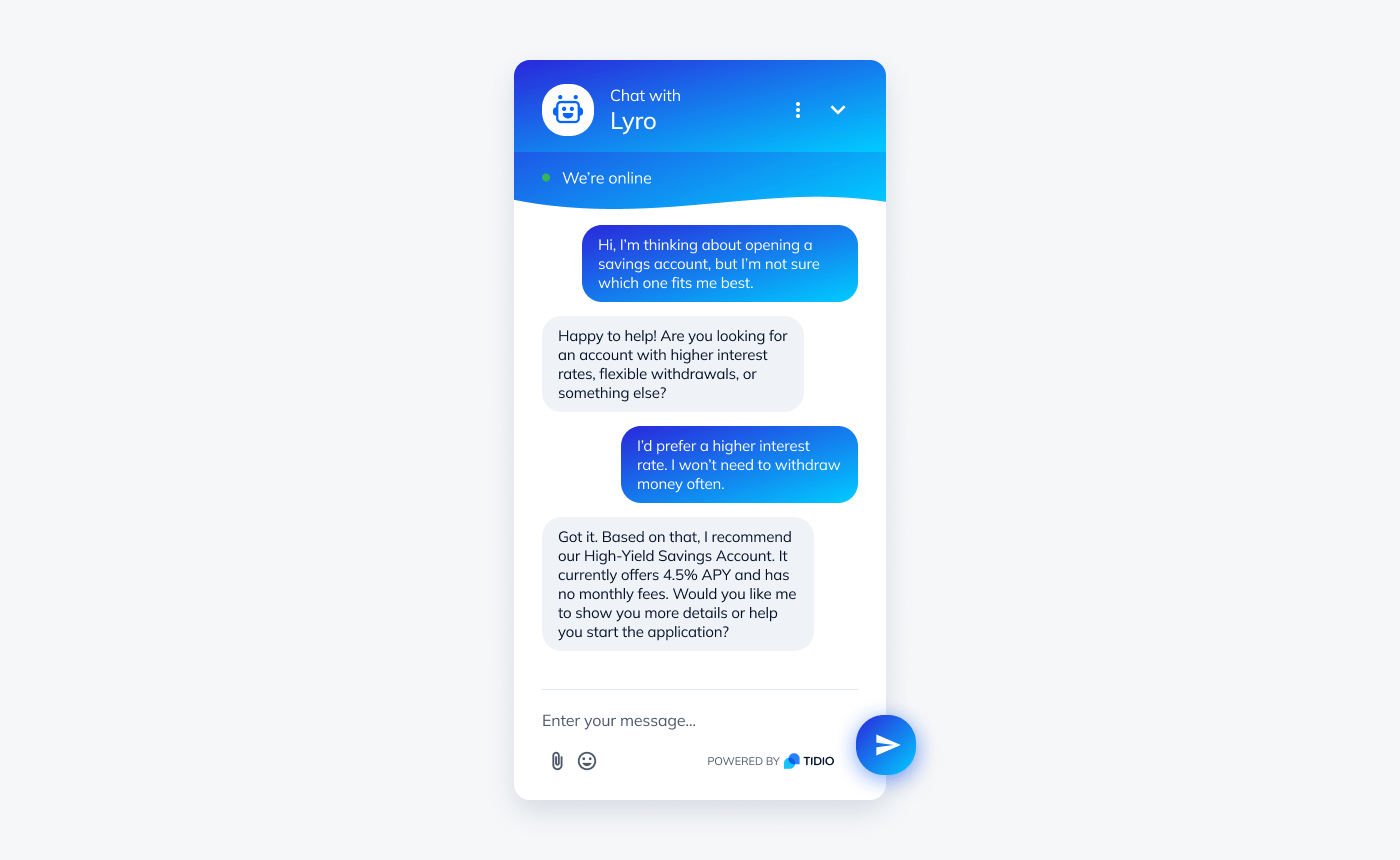

AI agents support sales processes by helping customers explore financial products and move forward with decisions. Many fintech users are interested in services like loans or investment accounts, but aren’t always sure where to begin. Instead of waiting for a sales rep to step in, an AI agent can offer guidance right from the first interaction.

Lyro AI Agent is built for this kind of assistance. It looks at each customer’s preferences and past conversations to suggest relevant options. If someone is browsing savings accounts, Lyro might highlight a product with a competitive rate or flag a time-sensitive promotion. It can also walk the customer through the next steps, answer questions about account features, and bring in a human advisor if needed. This keeps the user experience efficient while still personal.

Personalizing customer support

Fintech customers want quick, relevant answers. AI models help to deliver that by analyzing transaction history and user behavior to offer responses that feel personal.

With a better understanding of spending habits, these systems can suggest savings plans or loan options that actually match what a customer needs. In fact, the UK banks saw engagement jump fivefold after introducing AI-powered financial recommendations.

Software like Lyro AI Agent are capable of connecting with CRM systems and other tools to provide smarter replies. If someone asks about a loan, it can pull up key details and recommend the right products, or involve a human advisor if the situation calls for it.

By making smarter use of customer data, businesses can improve engagement and reduce the need for manual back-and-forth. That’s how personalization, when supported by artificial intelligence and data analysis, becomes a true asset in the financial industry.

Engaging users throughout the customer journey

In fintech, keeping customers engaged is critical, especially as more players compete for attention and loyalty. While acquiring new users matters, retaining them through clear, consistent support is what builds lasting relationships.

Lyro AI Agent supports this by responding to users in real time with helpful, context-aware replies. It doesn’t initiate conversations on its own, but it excels at reacting quickly and staying aligned with your brand’s voice. When users reach out, Lyro adapts its tone, understands intent, and delivers responses that feel consistent with your company’s messaging.

This responsiveness helps reduce drop-off during key moments, like product comparison or onboarding, and makes it easier for customers to move forward without friction. For example, if someone asks about eligibility or account benefits, Lyro can guide them toward the next step or connect them with a specialist, all while maintaining the tone and clarity your brand is known for.

Read more: Find out more about what makes an excellent chatbot persona.

Transform your fintech support with Lyro AI Agent

Common challenges of using AI in fintech and how to overcome them

AI is making fintech customer support more efficient, but it’s not without its hurdles. When not implemented thoughtfully, AI agents can miss the mark. For example, there’s a danger of giving inaccurate responses, struggling with compliance requirements, or leaving customers stuck when they need human help.

If automation isn’t fine-tuned, it can create more frustration than convenience. The key is to strike the right balance, ensuring AI enhances the customer experience rather than complicating it.

Let’s go through each challenge and see how you can tackle them head-on to build a smarter, more reliable support system.

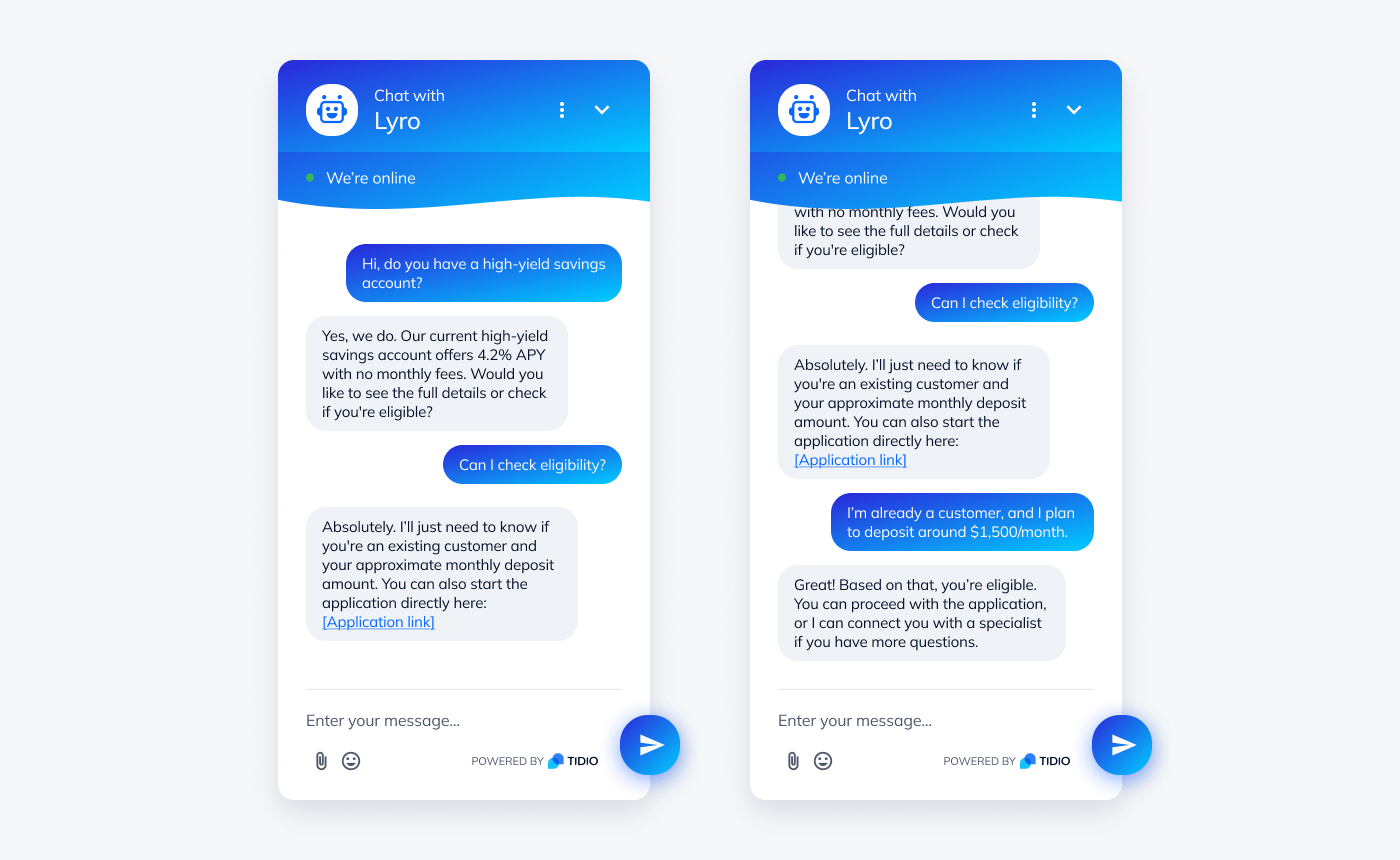

Challenge #1: Balancing automation with human support

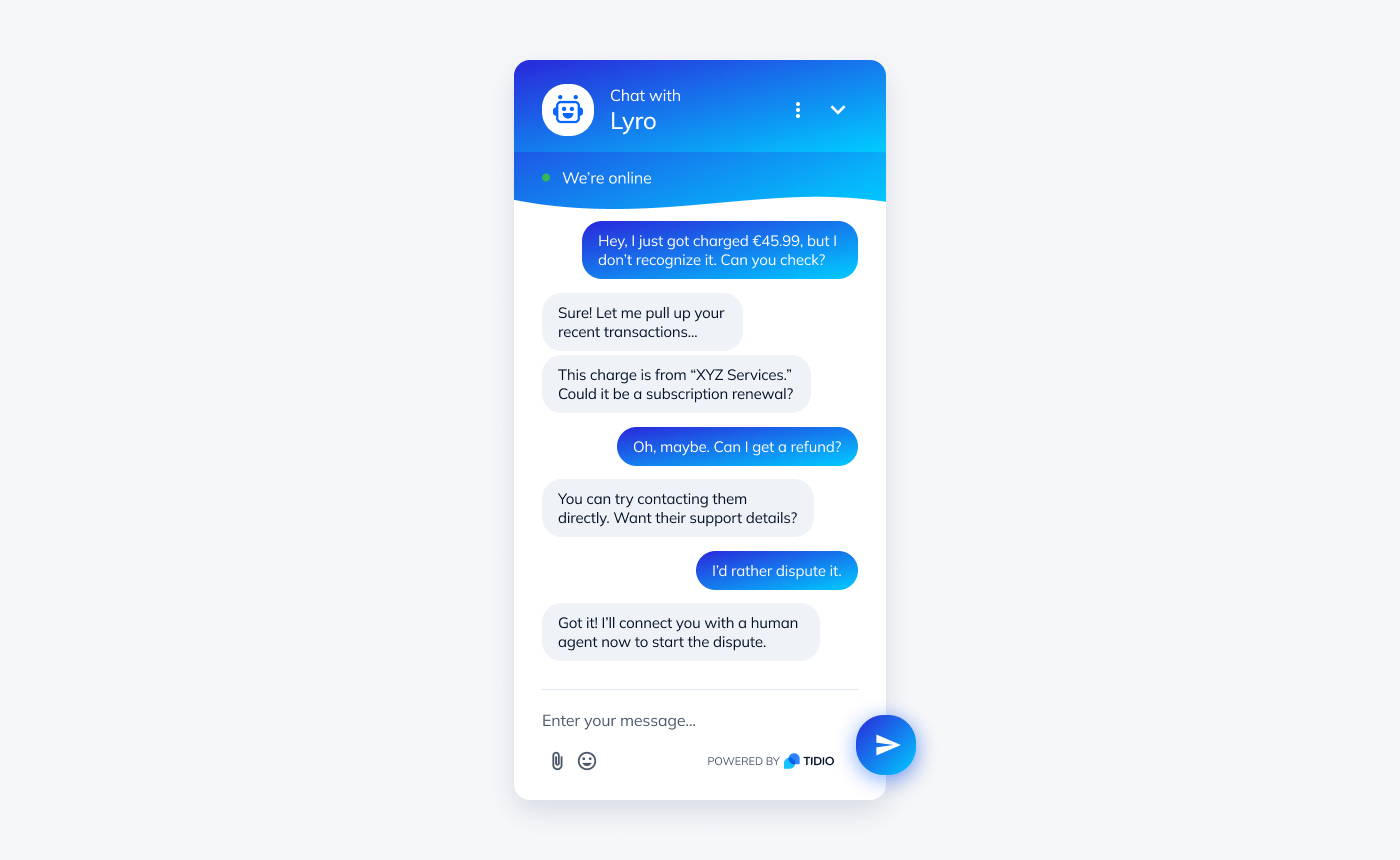

AI can handle a lot, but sometimes customers just need to speak to a real person. Especially when dealing with loan approvals, account disputes, or other complex financial matters. If AI makes it difficult to reach human support, frustration builds fast.

The key is to let AI do the heavy lifting while making sure human agents are easily accessible when needed. A smart handoff system ensures that more complicated cases get to the right person without unnecessary delays.

With Lyro, customers can move seamlessly from AI to a live representative, so they get fast, efficient support without feeling stuck in an automated loop. It’s about using AI to improve service, not replace the human connection that fintech customers still value.

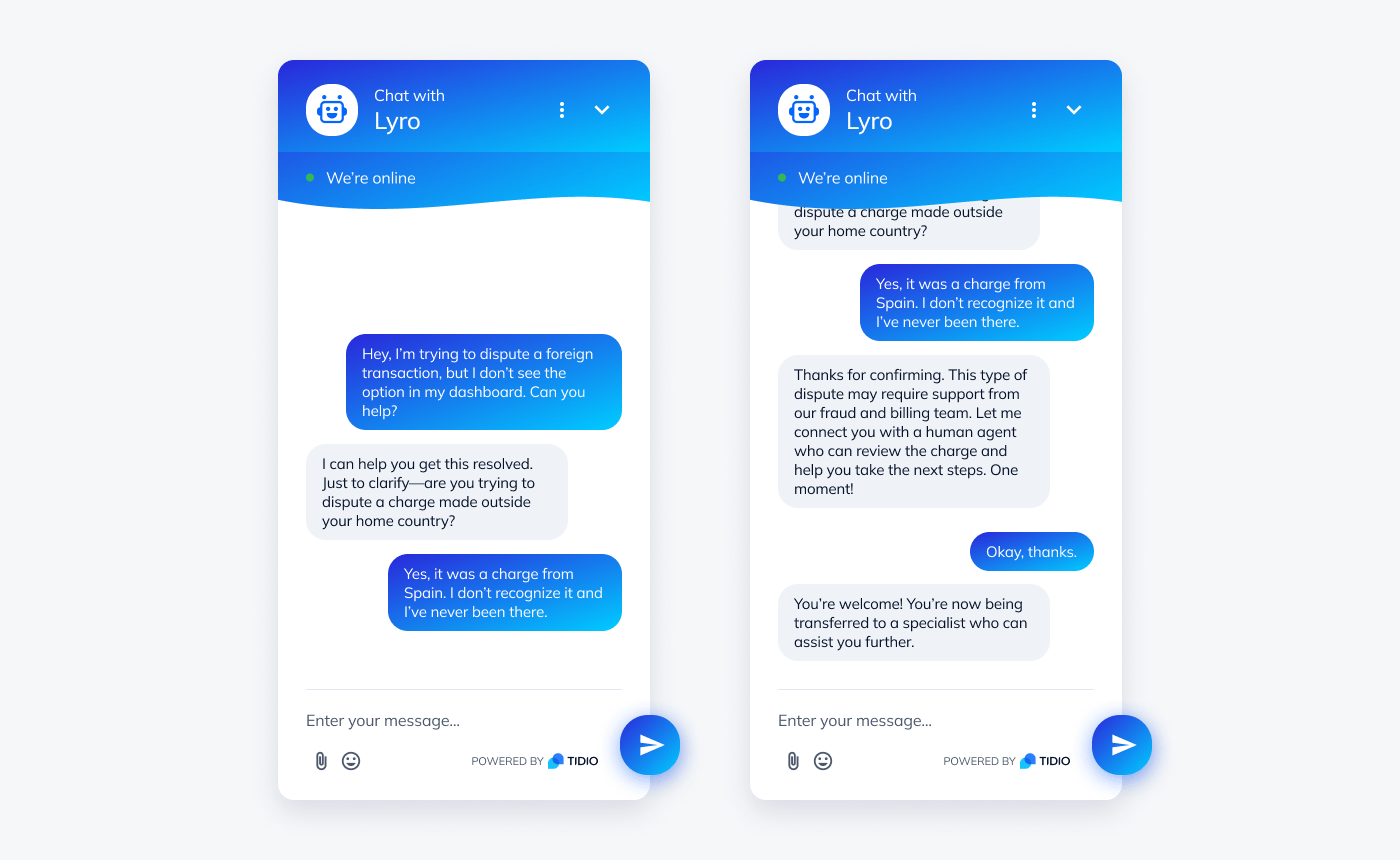

Challenge 2: Ensuring AI accuracy in financial queries

Customers expect precise answers when dealing with financial matters. Whether they’re asking about loan eligibility or disputing a transaction, AI must deliver responses that are both correct and compliant with industry regulations. A system that misinterprets a query or provides misleading information can quickly damage trust.

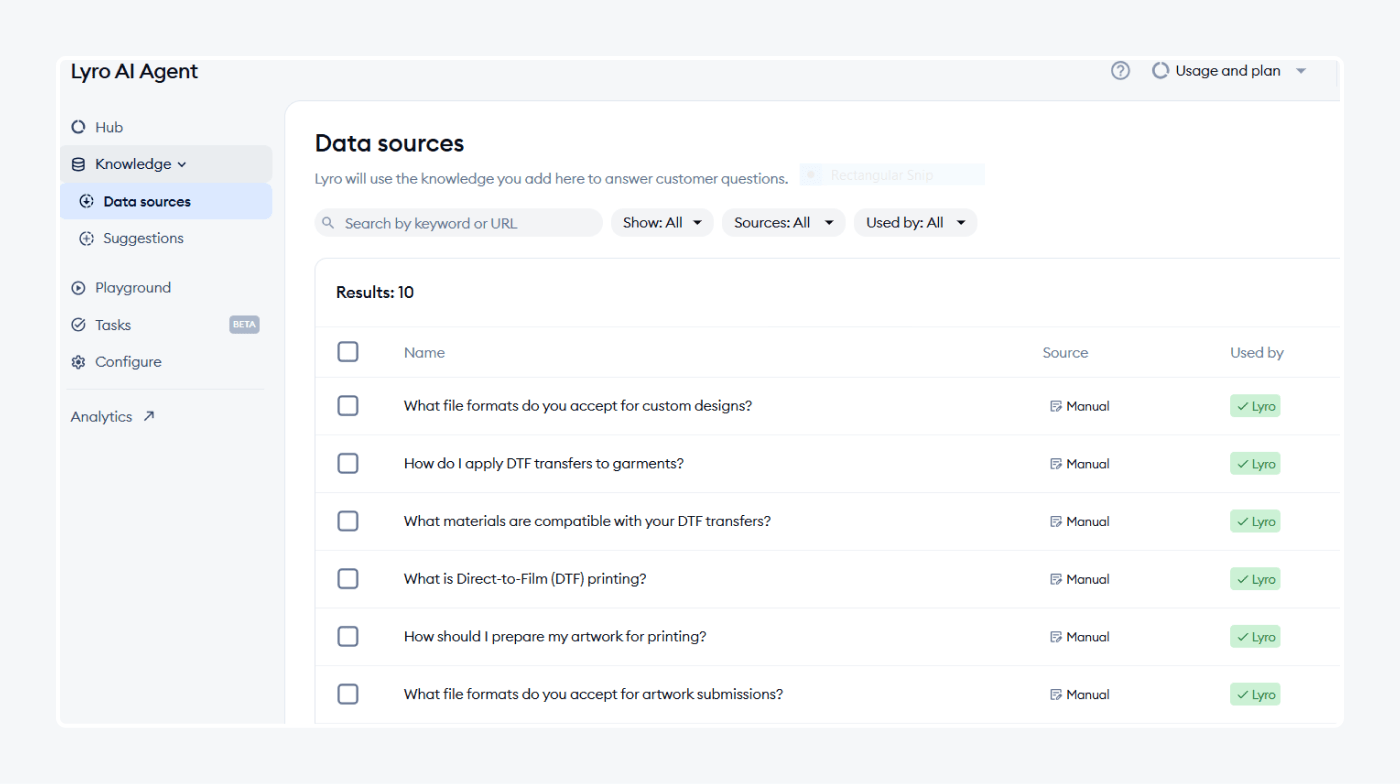

To maintain accuracy, AI needs structured financial data. Lyro pulls information from existing support content, such as company policies and FAQs, ensuring consistency across interactions.

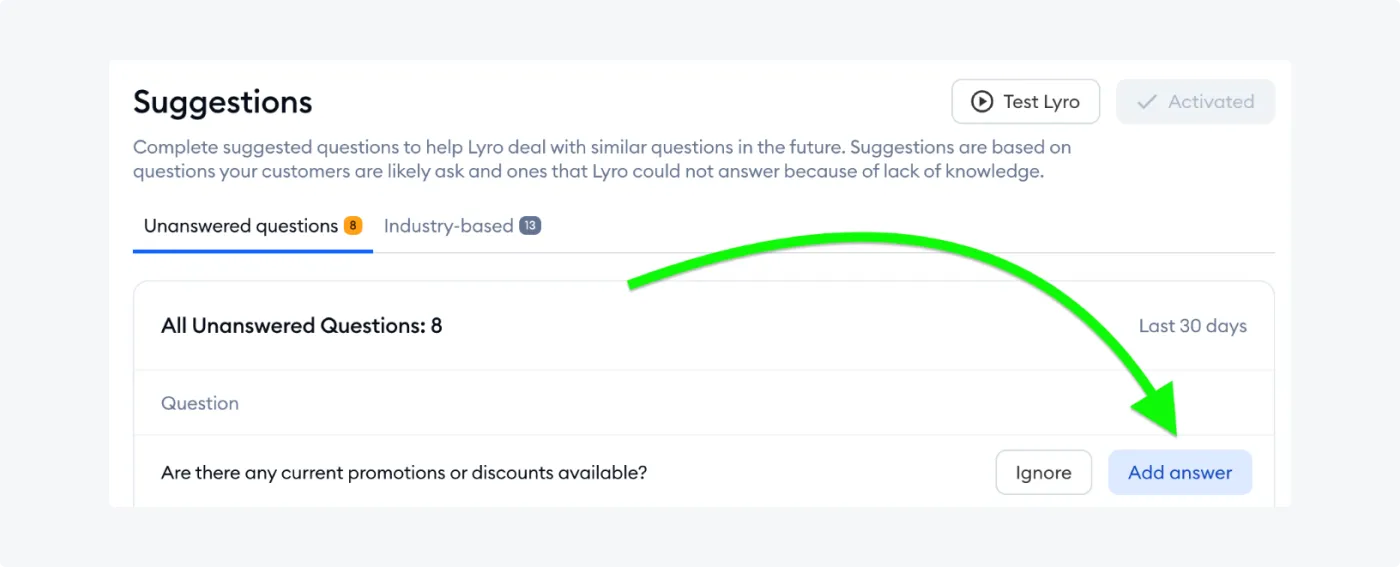

AI agents should also adapt in real time. When a question falls outside Lyro’s knowledge base, it identifies the gap and suggests updates internally so teams can refine responses. Instead of relying on static information, it continues to learn, improving over time.

Beyond answering questions, AI can personalize financial recommendations. Lyro analyzes customer preferences to suggest relevant products, such as loan options or investment plans, helping users make informed decisions without needing to contact human support.

Read more: Explore key steps to create a knowledge base chatbot.

Challenge 3: Handling high-volume inquiries without sacrificing quality

As fintech companies expand, so does the demand for customer support. A growing user base brings an increasing number of inquiries—some straightforward, others requiring detailed assistance. If AI isn’t properly configured, responses may become slow or overly generic, frustrating customers instead of helping them.

The key to maintaining both speed and accuracy lies in optimizing AI to handle high volumes while ensuring the quality of interactions remains consistent.

Lyro AI is designed to process thousands of inquiries at once, preventing long wait times even during peak hours. It instantly identifies common questions and provides precise answers, keeping interactions efficient.

For example, Shockbyte saw a 16% increase in customer satisfaction within just a few months of using Tidio.

For more complex cases, it uses smart query prioritization, recognizing urgent issues that require human intervention. This ensures that time-sensitive requests, such as transaction disputes or account security concerns, get escalated quickly to the right support agent.

Another advantage is asynchronous messaging support. Customers can start a conversation and return later without losing context, allowing them to get assistance on their own schedule. This reduces friction in the support process and keeps interactions fluid, whether handled by AI or a human agent. By balancing automation with intelligent routing, fintech companies can scale their support operations without sacrificing the level of service customers expect.

How to get started with AI in fintech support

Bringing AI into fintech customer support requires a structured approach. Careful planning helps businesses integrate AI while maintaining security, compliance, and efficiency.

Here are the steps you should follow for a successful head start:

Step 1: Choose the right AI platform

Before diving in, take a closer look at your current customer service setup. An AI agent is only one part of a larger support infrastructure, so it’s important to choose a solution that complements your help desk and workflows. Migrating platforms can be time-consuming and costly, so flexibility matters. Lyro AI Agent works within Tidio’s help desk but can also be integrated with external systems like Zendesk, making it a good fit for companies that want to keep their current tools in place.

Step 2: Prepare your data

To get accurate responses, feed your AI with content that reflects your business. Upload FAQs, policy documents, and service workflows so the system can deliver helpful answers from the beginning.

Step 3: Implement AI in phases

There’s no need to overhaul everything at once. Begin by automating repetitive questions, then expand to other areas like onboarding or account-related tasks once your team feels confident with the system.

Step 4: Monitor and refine with analytics

Once your AI agent is live, it’s important to keep an eye on how it’s performing. With Lyro, you can track key metrics like resolution rate, answer rate, and the number of queries passed to human agents. These give you a clear sense of what’s working and where adjustments might be needed.

Read more: Here are key chatbot analytics and metrics you should track.

AI Agents for fintech: key takeaway

Fintech companies are dealing with more customer inquiries than ever, and keeping up without sacrificing service quality is a challenge. AI-powered support helps ease that pressure by handling routine questions, directing more complex issues to the right agents, and making sure customers get quick, accurate responses.

Businesses using Lyro AI are seeing real benefits in under two months, from happier customers to lower costs and stronger engagement. As fintech companies grow, having AI-driven support in place means they can scale without stretching their teams too thin or slowing down service.

Now is the time to upgrade your customer support with AI designed for fintech. Lyro AI improves efficiency, lightens agent workload, and ensures compliance. It helps businesses scale without compromising service quality.

Get started today to stay ahead in a fast-moving industry.