Would you rather do business with customers who hand you big fat checks once in their lifetime? Or those who regularly pay you smaller amounts of money for years?

Well, there is a correct answer to that question. And it’s got nothing to do with relying on your gut feeling.

To answer this question like a pro, you need to calculate customer lifetime value first. It tells you which customers bring your company more value and make it sustainable in the long run.

What is Customer Lifetime Value, Anyway?

Customer lifetime value, in short CLV, is a prediction of how much an average customer will spend on your products or services over the entire relationship with your business.

Customer lifetime value isn’t just about the money customers spend on individual orders. It is about the long-term value of repeat customers. CLV calculation is a tool that enables you to target marketing efforts. Make better decisions about customer retention and segmentation strategies. Aiming for higher CLV means improving profitability.

So, How to Calculate Lifetime Value of a Customer?

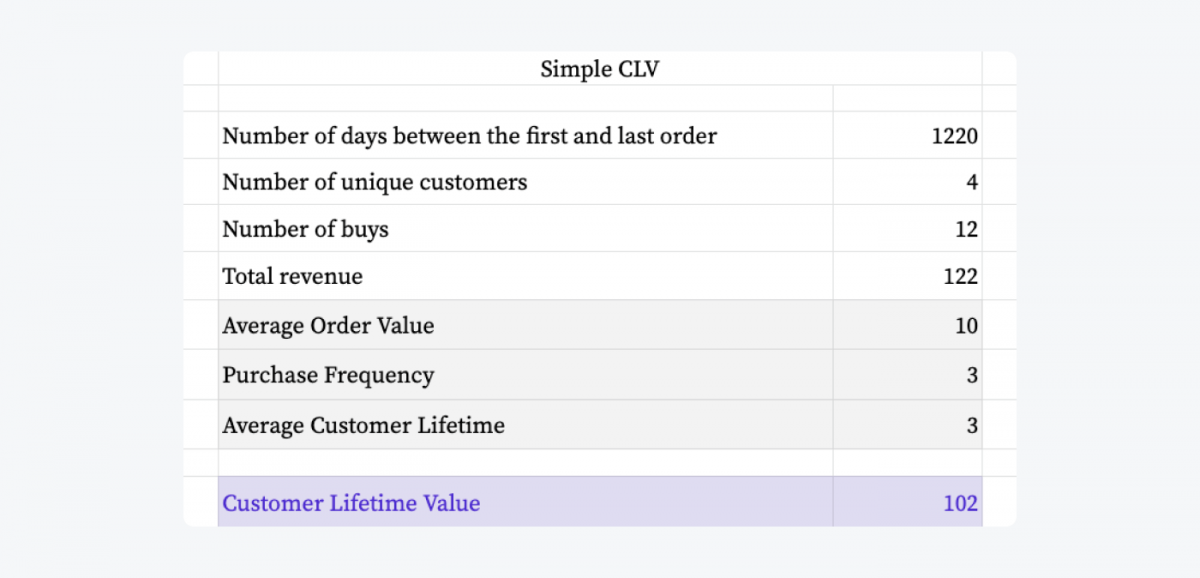

A simple CLV formula looks like this:

Customer Lifetime Value = Average Order Value X Purchase Frequency Rate X Average Customer Lifetime

Wait, doesn’t it make sense yet? Let’s break it down.

To calculate customer lifetime value, make sure you pick a certain period to gather the data—for example, a year.

- Take your total revenue and divide it by the number of buys. That’s your average order value (often abbreviated to AOV).

- Next, divide the total number of buys by the total number of unique customers. That’s your purchase frequency rate.

- Lastly, Average Customer Lifetime is the number of days between the first and last order date, divided by 365 (to convert into years).

You can calculate the customer lifetime value using this handy CLV excel template.

Why Are There Different CLV Formulas?

You will find that the CLV formula used in this article isn’t the only one you can find online. There are various calculations based on different approaches to CLV.

- There’s a historical approach that can also be tweaked by including a cohort analysis. For the formula, you only need total revenue and the total number of customers in the same period. Both methods allow you to predict your customers’ future behavior on the condition that your customer base is uniform.

- A predictive approach is more precise than historical because it applies algorithms. You need data on average transactions per month, AOV, average gross margin, and average customer lifespan in months.

- A traditional approach to calculating CLV works best if your sales fluctuate. Its formula considers the discount rate, average gross margin per lifespan of a single customer, and retention rate.

If you’re interested in how the other formulas work, explore different approaches to calculating CLV.

The formula in this article may not account for variables such as customer churn rate, discount rate, profit margins, retention costs. But it will still give you a solid understanding of specific issues and opportunities relating to the lifetime value of a customer.

If you want your results to be as accurate as possible, here’s a couple of more complex customer lifetime value formula Excel sheets:

- The Lifetime Customer Value Calculator tool by Harvard Business School

- Free CLV Excel templates

Every CLV calculation method has its advantages and drawbacks. The choice of your approach will depend on your resources and the type of your business. The formula in this article is handy when your retention is relatively low (less than 50%) and the average customer profitability over time is quite consistent.

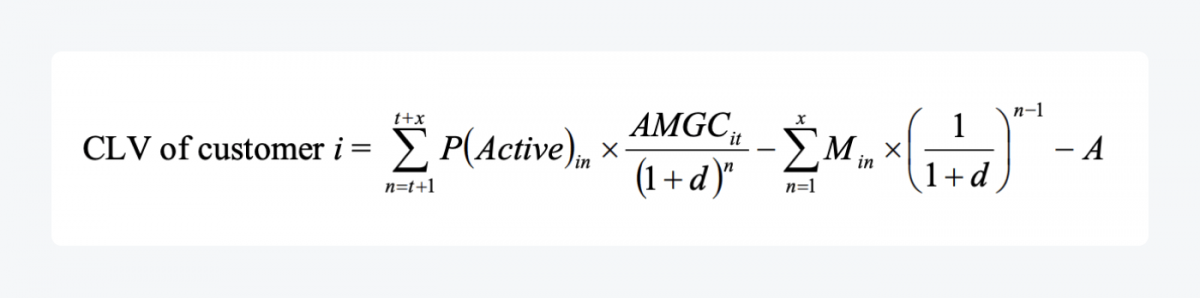

And it won’t give you a headache. Unlike a customer lifetime value equation in this 55-page study on measuring customer lifetime value below:

But Why Does Customer Lifetime Value Calculation Even Matter?

Listen—

You shouldn’t underestimate the importance of customer lifetime value.

By optimizing it, you can guarantee the stability and organic growth of your brand. Customer lifetime value calculation should underpin your company goals and has multiple implications for inbound marketing strategies in customer acquisition, retention, and more.

Let’s have a closer look at what knowing customer lifetime value can help you with:

Optimize your profit margins

The customer lifetime value calculated as a whole affects your customer profitability. If you only rely on new customers and their conversions, it means you have to pay the cost of acquisition for every customer.

On the other hand, optimizing for CLV means getting repeat purchases from customers you’d already acquired. In this case, you don’t have to pay for them again and get the entire profit margin of all orders after the first one. Thus, your ROI increases. Easy.

Plus, the higher the lifetime value of your customers, the less sensitive your business is to market fluctuations.

Recognize the best customers

Dr. Peter Fader, a lecturer at the University of Pennsylvania, says not all customers are equal, and it’s vital to understand the differences between them to allocate your resources effectively. As he puts it:

Instead of trying to transform every “ugly duckling” customer into a beautiful golden swan, businesses need to recognize the value of each customer and make appropriate decisions based on that knowledge.

Dr. Peter Fader

It means you can use CLV calculation for your business’ strategic advantage. By identifying the most valuable customer relationships, you can attract new customers with similar characteristics and do your best to retain them.

Push the right communication channels

If you measure the lifetime value of customers reaching you through different channels, you’ll see which ones are the best sources of quality leads. You just have to calculate CLV separately for customers who came organically and those who originated from PPC, email campaigns, or other channels.

This has a twofold benefit for your company. First off, you’ll discover which are the most profitable acquisition channels. Secondly, you’ll know how much you can invest in each channel to build your loyal customer base. You’ll be able to make smarter and more precise financial decisions rather than splash a lot of money everywhere.

Prioritize your products and services

Not all people find the same products or features equally important. Some might want free returns or a free trial period, while others can’t do without 24/7 customer support. You can do market research and gather feedback from your best customers. Then, focus on solving their major issues, improving your offering, and developing the products they need.

Thanks to the information they provided, you will strengthen your brand’s relationship with them. You’ll limit the risk of losing your most loyal customers. And prepare a tailored offer to reach out to prospective clients.

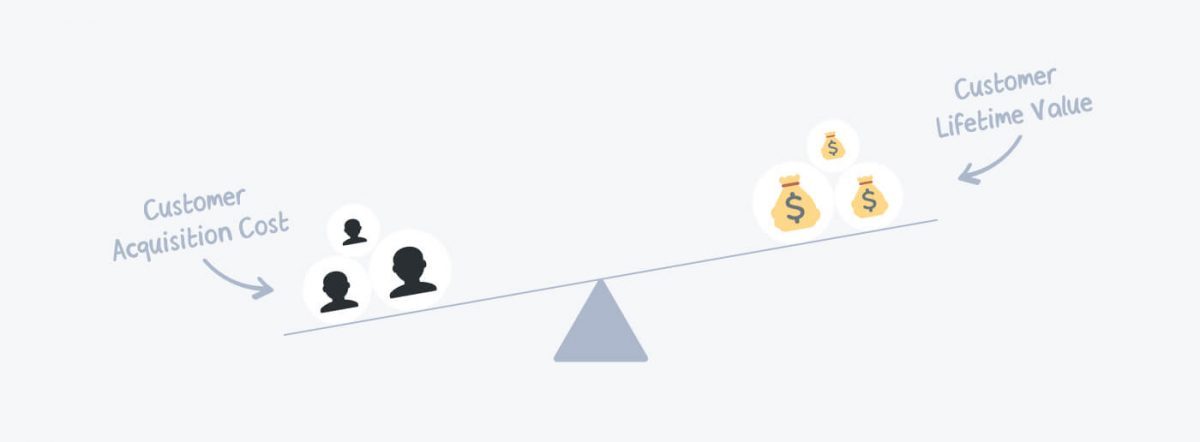

Determine how much to invest in acquisition

CLV is a long-term metric that should go hand in hand with customer acquisition cost (CAC). Both are the basis for calculating a short-term metric ROI (Return on Investment).

If you know how much profit your customers bring in, you’ll know how much you can spend to acquire and retain them. David Skok, a serial entrepreneur turned VC, calls the balanced ratio of the two metrics “the ability to monetize acquired customers.”

A popular idea flying about the internet is that CAC costs 5x more than retention.

You should know, though, the (in)famous rule isn’t universal. It’s only an estimation based on companies with mass-scale production and aggressive sales tactics.

So do NOT jump right into it.

Not without calculating customer lifetime value specifically for your brand.

If you calculate customer lifetime value yourself, you’ll get an accurate result that you can apply to your own business.

Pro Tip: CLV should be higher than CAC to keep your company afloat. But the ratio will differ for each company.

What are the risks of ignoring CLV?

Ignoring CLV can cost you money. And the larger your company is, the higher the stakes.

Listen to Dr. Peter Fader’s TED Talk in which he shares an example of a real-life company that suffered huge losses because they’d failed to apply CLV in the revenue forecast.

Here’s a quick rundown:

In 2017 he asked his students to forecast how many customers a subscription TV company would acquire in the next year, and compared their results with Wall Street experts’ projections.

How did they do?

The experts’ projection was 30% higher than the actual number. It meant a loss of a billion dollars of shareholder value in a week. The students nailed it, though. Their estimate was only 0.5% different.

They got such an accurate result because they accounted for customer lifetime value calculation in their estimation while the Wall Street experts did not.

Failing to consider customer lifetime value can have even more far-reaching effects for some companies.

Skok thinks the second biggest cause of startup failure is when a business can’t balance the customer lifetime value and the cost of acquiring them.

And yet—

According to a report produced by Econsultancy in partnership with Sitecore, only 4 out of 10 company owners get the CLV calculation right.

You don’t want to be in that bottom 6, do you?

How to Apply Customer Lifetime Value in Real Life?

CLV is used to support acquisition and retention strategies. It tells you what’s working and what’s not. What draws customers to your company, who repeat customers are, and who is most likely to drop out. Let’s look at some examples demonstrating how businesses can take advantage of customer lifetime value in practice.

Prioritize the right type of customer

The customer lifetime value calculation can sometimes be misleading. This is because not all customers are worth the same for your business. To properly understand your customers, costs, and financial benefits, you need to segment your market.

When it comes to customer lifetime value, you can identify groups based on their budget or the length of your relationship. You can start with using common sense or use tried and tested customer segmentation strategies.

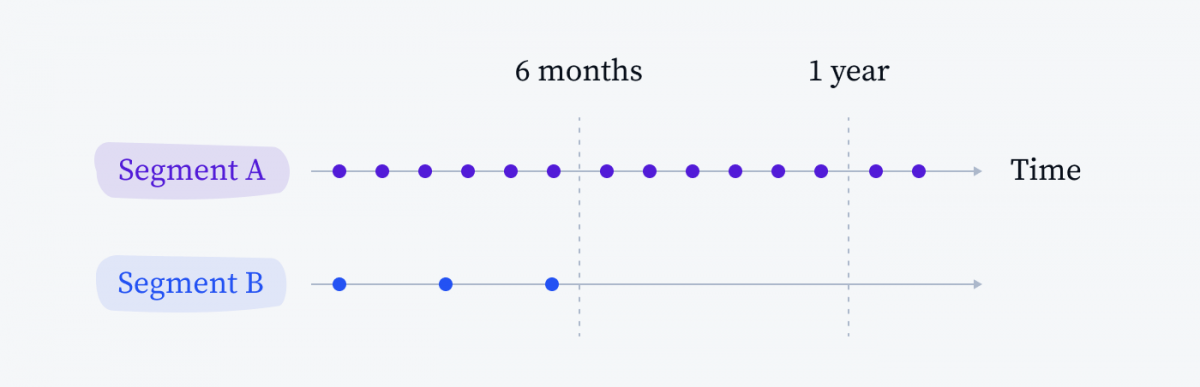

Here’s an example of how CLV analysis of customer segments can benefit your business.

Let’s imagine a group of customers who order cheaper wine every month and stay loyal for four years (segment A). And compare them to a group that places three orders for fancier wine and abandons you after six months (segment B). The numbers are average.

Segment A:

An average $50 per order x 12 orders a year x 4 years = $2,400 CLV

Segment B

An average $250 per order x 3 orders a year x 0.5 year = $375 CLV

This means segment A has a higher lifetime value than segment B.

In this scenario, you can also try to minimize churn for valuable clients (segment A) or try to increase the lifetime value of segment B.

Improve your subscription model

Now, think of Netflix or Spotify. They do measure your value as a customer.

They certainly segment their clients as well.

That’s why they can offer different plans (e.g. family) or discounts and determine the length of free trials.

If you too are in a SaaS or subscription-based business, focus on customer lifetime value calculation and retention rates. I can’t stress this enough. You invest a lot at the beginning of your relationship with a customer (acquisition costs, plus maybe trial). So naturally, you want to get your investment back. Or at least break even.

Here’s a CLV example for a subscription-based business model.

A milk delivery service offers 3 types of weekly subscriptions: $17 standard, $40 family, and $20 office. Let’s calculate CLV for the office subscription plan. Office subscribers in this example stay for 20 months on average.

$20 subscription plan for the offices x 4 orders a month x 20 months = $1,600

In this case, you want to make sure that your costs are covered before the office clients break up with you. If they leave too early, try improving the CLV metric or adjusting the pricing.

With this predictive understanding of the relationship with office clients, you can invest in acquiring a specific type of customer. Even if it may be at a loss at first.

Prepare winning campaigns

Let’s assume that you designed two campaigns for a new line of beauty products: PPC and Facebook Ads. You optimized them for recurring sales rather than one-off revenue.

In the case of the PPC campaign, you’ve spent $2,000 and acquired 25 new customers. On average they placed 2.5 orders in 1.5 years and spent $40 per order. So your CLV is $150.

Your budget for Facebook Ads was $1,000 and it earned you 40 new customers who on average placed 4 orders in 2 years and spent $35 per order. Their lifetime value equals $280.

From the ROI perspective, both campaigns were successful. You’ve made a profit on both of them. But you’ll notice the Facebook Ads campaign brought you nearly twice as valuable customers as the PPC campaign. They were more loyal and were ready to shop with you more frequently. You can then try to repeat the same campaign to target the specific group through different channels.

How to Increase Customer Lifetime Value?

To answer this question, look at the CLV formula again.

If you want to increase the CLV metric, you either have to make your customers increase their shopping cart value, make them shop with you more often, or make them stay longer with you. Or increase them altogether—to take the world by a storm.

The tips below are awesome for boosting customer lifetime value. Whether you’re an online retailer, run an offline shop, or are in SaaS and subscription business.

Satisfy your customers

Customer satisfaction is key to keeping your clients for longer. A Microsoft study into customer behavior found that 3 in 5 Americans stopped doing business with a brand because of a poor experience. This can be detrimental to a brand.

On the other hand, Americans are willing to spend 17% more to do business with companies that deliver excellent service. This is a raise up from 14 percent in three years. As you might have guessed, millennials as a group are willing to spend the most for great customer care.

Consider going the extra mile to satisfy the customer, especially at the beginning of the customer relationship. This is the main principle of relationship marketing. To improve customer experience with your brand (and boost your CLV metrics), make sure the website runs smoothly.

Offer stellar customer support

Here are some more insights into customer lifetime value from the same Microsoft study.

To turn new customers into repeated ones, provide online self-service support (9 in 10 people expect that). Make it 24/7. And be friendly and proactive in doing so. Is this really necessary, you may ask? Yes! The majority of customers (83%, to be exact) need help with completing the purchase.

Not to worry—you can easily meet this demand with our free Tidio chatbot.

As a bonus, web chat is a preferred method of interacting with brands for younger generations—63% of millennials go for a live chat rather than traditional channels.

Reward customers’ loyalty

According to a Morning Consult report on what drives customer loyalty, younger generations (Gen Z and millennials) are likely to experiment with other brands, even though they know there’s one they like (51% and 41% respectively).

You can give them a little nudge to commit to your brand by offering a loyalty program. It’s especially helpful if your brand has dense competition. (Who doesn’t, right?)

To boost the lifetime value of a customer, retailers can offer programs based on points. Usually, the more customers spend, the better discount they get in the future. Some brands give loyalty points for other activities, too. For example, for writing a review or a follow on social media.

In the midst of the pandemic, some brands realized they could offer their best customers a virtual experience. These take the form of a one-to-one consultation or a podcast.

Simplify your customer onboarding process

If you’re in a subscription-based business, it’s your top job to prevent your customers from churning. Focus on creating a buttery-smooth onboarding process. It’s down to a poor onboarding experience that 23% of existing customers cancel or don’t renew their subscriptions.

Onboarding is an excellent opportunity for you to engage with new subscribers and improve your customer lifetime value model. So it’s crucial that you put together a solid customer engagement strategy to integrate them into your business. Create step-by-step guides and tutorials, how-to videos, and other helpful content that makes the onboarding process easy and hassle-free. It’s up to you to help customers achieve their goals by simplifying their tasks so they stay for longer.

Always test onboarding approaches and measure their effectiveness. You don’t have to get this right the first time.

Upsell and cross-sell your products

One of the critical elements in the CLV calculation for eCommerce is the purchase value. One way of increasing it is by inspiring customers to buy more expensive or upgraded products and services. It’s called upselling. It can take the form of add-ons, such as warranty, insurance, or extra services. Or a suggestion to switch a bigger or better version of a product in the cart.

Another way of increasing AOV is upselling’s cousin, called cross-selling. It’s offering products that complement items a customer already put in their cart. It works like magic for clothes retailers who can present a whole look to match one pair of jeans.

Statistics show that upselling drives over 4% of sales. And cross-selling adds to 0.2% of sales. It may not seem like a colossal improvement, but there’s no reason for marketers to snub a few percent boost. You can maximize the profit by combining the two techniques.

A Quick Wrap Up

You know customers are the heartbeat of your business. And how hard it is to acquire them. But once they become your clients, it’s worth looking back and checking which ones strengthen your brand’s performance most. This is what the customer lifetime value metric is for.

Here’s what to remember when calculating the lifetime value of your customer:

- The lifetime value of a customer is an important indicator of your brand’s long-term relationship with customers.

- You can use it to target your marketing to the most valuable customers—retain or acquire them.

- CLV tells you how much you can invest to attract customers. It should be considered along with CAC.

- Not all customers are equal. Segment them and calculate customer lifetime value for each segment to get a clearer picture of costs and financial benefits.